https://www.hgcmedical.com/

Report Overview

The global medical equipment maintenance market size was valued at USD 35.3 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 7.9% from 2021 to 2027. Growing global demand for medical devices, rising prevalence of life-threatening diseases leading to higher diagnostic rates, and rising demand for the refurbished medical equipment are expected to drive the market for medical device maintenance during the forecast period. Currently, several medical devices such as syringe pumps, electrocardiographs, X-ray units, centrifuge, ventilator units, ultrasound, and autoclave are available in the healthcare industry. These are used for treatment, diagnosis, analysis, and educational purposes across the healthcare industry.

As most medical devices are sophisticated, complex, and expensive, their maintenance is a very critical task. Maintenance of medical devices ensures that the devices are error free and operating accurately. In addition, its role in reducing errors, calibration, and risk of contamination is expected to contribute to market growth. Moreover, in the coming years, the requirement of technological expertise in remote maintenance and management of devices is expected to grow. This trend, in turn, is anticipated to drive strategic decisions for the industry.

Furthermore, increasing global disposable income, rising medical device approvals, and growing adoption of new technologies in emerging countries are projected to further fuel the sales of medical devices, in turn, promoting the maintenance demand. Due to the growing geriatric population, higher expenditure is witnessed for remote patient monitoring devices. And these devices require higher maintenance, which is expected to carry on over the forecast period, thus contributing to the market revenue.

As per a survey carried out by the Population Reference Bureau in 2019, at present, there are over 52 million people in the U.S. aged 65 years and above. Whereas, this number is anticipated to increase to 61 million by 2027. The geriatric population presents a greater exposure to chronic conditions, such as diabetes, cancer, and other lifestyle chronic disorders. Hospitals and healthcare delivering facilities also significantly contribute to medical equipment maintenance revenue.

Equipment Insights

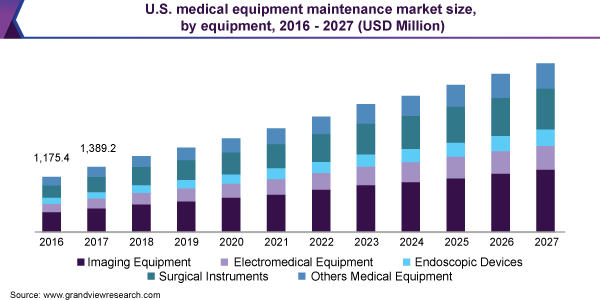

Based on equipment the market for medical device maintenance has been segmented into imaging equipment, electromedical equipment, endoscopic devices, surgical instruments, and other medical equipment. The imaging equipment segment accounted for the largest revenue share of 35.8% in 2020, which includes several devices such as CT, MRI, Digital X-Ray, ultrasound, and others. A rise in the global diagnostic procedures and increasing heart diseases are driving the segment.

The surgical instruments segment is expected to register the highest CAGR of 8.4% over the forecast period. This can be attributed to augmenting global surgical procedures due to the introduction of non-invasive and robotic solutions. According to the Plastic Surgery Statistics Report, about 1.8 million cosmetic surgical procedures were performed in 2019 in the U.S.

Regional Insights

North America accounted for the largest revenue share of 38.4% in 2020 owing to the advanced medical infrastructure, rising prevalence of chronic diseases, higher healthcare spending, and a large number of hospitals and ambulatory surgical centers in the region. In addition, higher demand for advanced medical devices in the region is anticipated to propel the market growth in the region.

Asia Pacific is expected to witness the fastest growth over the forecast period due to the growing geriatric population, government initiatives to provide better healthcare services, and rising healthcare spending in the region. For instance, the Government of India launched the Ayushman Bharat Yojana in 2018 to offer free access to healthcare for 40% of people in the country.

Key Companies & Market Share Insights

Companies are adopting partnership as a key strategy to sustain in the highly competitive environment and acquire a greater market share. For instance, in July 2018, Philips signed two long-term delivery, upgrade, replacement, and maintenance partnership agreements with Kliniken der Stadt Köln, a hospital group in Germany.

| Report Attribute | Details |

| Market size value in 2021 | USD 39.0 billion |

| Revenue forecast in 2027 | USD 61.7 billion |

| Growth Rate | CAGR of 7.9% from 2021 to 2027 |

| Base year for estimation | 2020 |

| Historical data | 2016 - 2019 |

| Forecast period | 2021 - 2027 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2021 to 2027 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Equipment, service, region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE |

| Key companies profiled | GE Healthcare; Siemens Healthineers; Koninklijke Philips N.V.; Drägerwerk AG & Co. KGaA; Medtronic; B. Braun Melsungen AG; Aramark; BC Technical, Inc.; Alliance Medical Group; Althea Group |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. Explore purchase options |

Post time: Jun-30-2023